From an email I just got:

Liftoff: Show me the incentives and I'll show you the outcome.

Charlie Munger famously said, “show me the incentives and I’ll show you the outcome.”

In other words, incentives are a powerful force that drive nearly all human behavior.

Incentives are why capitalism works and why socialism can’t work.

Let’s examine the incentives underlying Bitcoin and its path to adoption.

For Bitcoin to reach global dominance, it must inspire a vibrant ecosystem of allies.

Bitcoin needs allies, the stronger the better. Fortunately, Bitcoin is attracting new users at an unprecedented rate. People adopt Bitcoin for many reasons, including to:

- Get wealthy

- Stay wealthy

- Preserve freedom

- Make easy global payments

- Help repair a broken monetary system

- Increase prosperity in the world

Once someone adopts Bitcoin they are incentivized to defend, improve and grow the network. And everyone who joins the network contributes to the network as a whole.

In other words, Bitcoin is as strong as its strongest link.

How are Bitcoin’s incentives playing out in the real world?

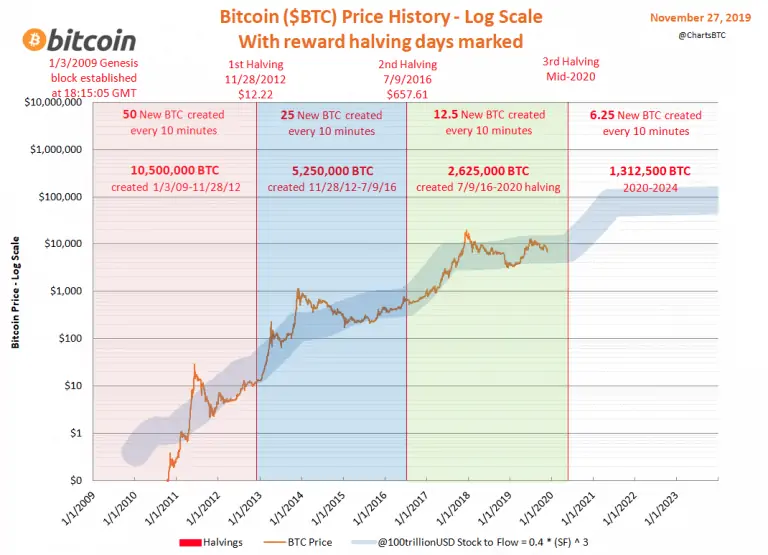

Many investors buy Bitcoin to generate wealth. No surprise there: it’s the best performing asset of the last decade, up 500% in the last year, and currently ~60,000 people are buying Bitcoin for the first time every day.

In this macroeconomic environment, governments are forced to devalue their currency and many corporations cannot keep up. Savvy corporations realize this and are buying Bitcoin to protect their melting balance sheets.

In fact, corporations like Tesla, Square, and Microstrategy have already acquired billions in Bitcoin. Currently, 6% of the Bitcoin supply is owned by corporations, and the FAANG companies haven’t started buying yet…

People and corporations are incentivized to go where they’re treated best.

- Government officials realize this and are using Bitcoin as a tool to attract talent and pools of capital.

- Kentucky offers tax breaks to attract Bitcoin miners.

- Wyoming offers a new banking license that lures Bitcoin banks and businesses.

- Miami has rebranded as a “Bitcoin and tech hub,” offering favorable laws, low taxes, and exploring ways to pay their employees in Bitcoin.

It starts with local jurisdictions but eventually nation states will be incentivized to do the same. And when governments compete the individual benefits.

Pensions and insurance companies need Bitcoin to generate a positive yield.

With mounting unfunded liabilities, $17T in negative-yielding bonds, and few options for positive yield, money managers will be forced to buy Bitcoin. It’s their only hope.

Bitcoiners adopt Bitcoin because it’s the right thing to do.

The current system is not working for the vast majority of people. Bitcoin shifts power from the rent-seeking incumbents to the individual.

Bitcoin levels the playing field. Anyone with an internet connection can benefit from its price appreciation, whether you're a billionaire or you sell coconuts in Costa Rica.

Bitcoiners realize the positive impact of Bitcoin which inspires them to ensure its success

Corporations and the major banks used to dismiss Bitcoin.

However, in the last year, we’ve seen almost all of them becoming Bitcoin bulls. Why?

Because they realized it’s in their best interest to adopt Bitcoin to generate revenue and protect market share. Makes sense.

Bitcoin aligns incentives unlike anything before.

Bitcoin is attracting everyone from billionaires and corporations to middle-class wage earners and the unbanked. After storing some wealth in Bitcoin, they have an incentive to support the Bitcoin network.

It’s a virtuous cycle with each new user making the network stronger and more valuable. Bitcoin aligns incentives unlike anything in human history.

Show me the incentives and I’ll show you the outcome.