Disgusted With Obama Administration.

-

Manhattan BuckeyeIggyPride00;1253137 wrote:Is everyone ready for the continued spike in gas prices, food and everything else we actually use?

Word of the Fed minutes today indicated that they are primed to do some more quantitative easing (printing money) and commodities are set to continue soaring.

You couple that with the hurricance season and you have a recipe for speculators to go wild.

Wallstreet has it made right now. The market has doubled off its March 2009 lows, and they haven't had to do anything to help get the economy moving. All they do is sit on their collective hands, and in turn the Fed gives out more stimulus which just drives the market higher while doing very little to help the real economy (jobs).

We are stuck in a giant negative feedback loop right now. Wallstreet and financial institutions have zero incentive to get this economy going, because the less they do the more they get from the Fed and the government. The market off goes up on bad news anymore in antiicipation of more freebies and goodies from Helicopter Ben.

If the economy started taking off, the punchbowl would be taken away, interest rates would go up, and the Fed balance sheet would shrink. All of which would make business more expensive for financial institutions. They have a perverse incentive to keep us stuck in misery.

So in the meantime we normal folks get stuck with surging commodity costs and economic stagnation because of the Fed's "help". Thanks alot.

Hitting Asia today:

http://finance.yahoo.com/news/asian-shares-retreat-dim-outlook-024726057.html

Obama or Romney, whoever wins has to change our fiscal policies. Obama and Bernanke have destructed our global economy, the former due to ignorance and the latter due to incompetence. -

sjmvsfscs08[video=youtube;Z-m0S1vJCb8][/video]

35:50 onward - perfectly explains the Obama campaign today.

12:41 onward - Obama has failed miserably by his own stated standards of his party

17:53 onward - "let me spell out exactly what that change would mean if I'm President...." ....and then a litany of unaccomplished bullshit. -

BoatShoes

Well the piece you cite suggests stocks retreated because they were hoping the FED would give more of a sign that they were going to pursue QE3. At this point it's really a no brainer that they should be doing more. Core inflation is projected below the target rate for several years and the unemployment rate has been, and is projected to be, way above the target rate for several years.Manhattan Buckeye;1253454 wrote:...the latter due to incompetence.

What is it that you think the Federal Reserve should do in the face of dreadfully high unemployment and low inflation? -

BoatShoes

Even if you accept that he hasn't accomplished what he wanted or done a great job...if what the replacements are offering would clearly be worse based on the evidence. We've got the GOP now arguing to go back to the gold standard. It'd be nice if there was a better choice than the modern republican party but this is what we got.sjmvsfscs08;1253493 wrote:[video=youtube;Z-m0S1vJCb8][/video]

35:50 onward - perfectly explains the Obama campaign today.

12:41 onward - Obama has failed miserably by his own stated standards of his party

17:53 onward - "let me spell out exactly what that change would mean if I'm President...." ....and then a litany of unaccomplished bullshit.

Braxton Miller goes out and throws some interceptions in the first half you don't put Joe Bauserman in for the second half. Maybe you wish you would've landed Tajh Boyd who was almost a Buckeye but you've got to choose between who you got.

You think it can't be worse but it definitely can. Milder versions of what Romney and Ryan want to do are wreaking havoc in this world because they are terrible policies to enact when interest rates are at zero and the economy is depressed. A perfect example would be the Gold Standard which even Milton Friedman argued was a primary cause of the Great Depression. -

Manhattan BuckeyeBarack Obama = Joe Bauserman multiplied by Austin Mocherman to the Steve Bellasari's power. He hasn't just been bad, he's terrible regardless of whether you believe in his politics. He's an unaccomplished person that was lifted to POTUS because of anti-Bush sentiment and super-leftists opening doors to him right and left without opposition. Now there is opposition. The guy has done a poor job. And Biden, my god......

-

believer

You'll get no argument out of me. Sums it up nicely.Manhattan Buckeye;1253539 wrote:Barack Obama = Joe Bauserman multiplied by Austin Mocherman to the Steve Bellasari's power. He hasn't just been bad, he's terrible regardless of whether you believe in his politics. He's an unaccomplished person that was lifted to POTUS because of anti-Bush sentiment and super-leftists opening doors to him right and left without opposition. Now there is opposition. The guy has done a poor job. And Biden, my god...... -

IggyPride00

Core inflation is a complete joke, and not something to be basing money printing decisions off of in 2012.At this point it's really a no brainer that they should be doing more. Core inflation is projected below the target rate

Food, energy, tuition, healthcare costs, and commodities are all well over the 2% rate of inflation the Fed targets. Those are things that normal people use and deal with on a daily basis. They are all up, up and away right now.

When you strip out food and energy of course the number is below the target.

So you really think that printing more money is going to help? They are already at the zero bound on interest rates, they have driven down mortgage rates almost as far as they can go? What exactly is turning on the printing presses going to do?

It seems to me to be a formula to just continue to drive asset prices higher and make things more expensive for middle class people without adding jobs or helping the broader economy. It will continue to help line Wallstreet's pockets as QE1 and 2 did, but it does nothing to help create jobs at this point.

The longer we operate in a 0% interest rate environment the harder it is ever going to be to get off it. It is not realistic, but you have financial institutions that are so dependent on it for their business model now that they will be unwilling to see the economy improve in a way that takes it away. It is a perverse incentive to keep things stagnant. Corporate profits have never been higher, and the worse things get the more freebies they get.

They have already largely discounted the effect QE3 is going to have, and the second it happens the clamoring for QE4 will begin. It's like giving a heroin addict a huge stash and telling them to make it last. They can't, and will be looking for the next score before they have even come down off the initial high. -

sjmvsfscs08

This basically is the third section of the campaign speech. You don't have any good ideas, so make people afraid of Mitt Romney. It's pretty damn weak.BoatShoes;1253501 wrote:Even if you accept that he hasn't accomplished what he wanted or done a great job...if what the replacements are offering would clearly be worse based on the evidence. We've got the GOP now arguing to go back to the gold standard. It'd be nice if there was a better choice than the modern republican party but this is what we got.

Braxton Miller goes out and throws some interceptions in the first half you don't put Joe Bauserman in for the second half. Maybe you wish you would've landed Tajh Boyd who was almost a Buckeye but you've got to choose between who you got.

You think it can't be worse but it definitely can. Milder versions of what Romney and Ryan want to do are wreaking havoc in this world because they are terrible policies to enact when interest rates are at zero and the economy is depressed. A perfect example would be the Gold Standard which even Milton Friedman argued was a primary cause of the Great Depression. -

QuakerOats

Businesses pay unemployment compensation through U/C taxes, and then through higher U/C taxes after they have had layoffs and must replenish their balances (state and federal). We have thrown an extra $1.3 trillion per year in federal spending for 4 years now, but instead of directing it in a way to instill confidence we have done the opposite. It is simply a handout and in effect a declaration from the obama team that "we have no idea what we are doing, we have no plan for growth, we have no tax reform, we are heaping more and more and more regulations and laws at businesses, and we cannot instill any sense of confidence in the economy, so we are just going to give the incremental unemployed and public sector unions trillions of dollars and hope we get elected again".BoatShoes;1253332 wrote:Just as one example of one thing you'd have to do when unemployment is over 8% is you'd have to stop paying for food stamps and unemployment insurance for the unemployed which increase automatically in recessions even without Congress deciding for it to happen. What do you propose to do about that. If the unemployed suddenly were completely broke, demand drops further and unemployment goes up even higher and our budget problems get worse.

How do you propose dealing with the type of spending that rises automatically when unemployment is so high?

Some of us could quickly reduce spending and put forth a plan that would indeed balance the budget and begin to reduce the debt. We simply have the WRONG PEOPLE running the show right now and NOTHING IS GOING TO GET BETTER until there is a change in the White House and then in every cabinet position on down the line.

You cannot run a captialist economy with a communist policy agenda; heck communist policy doesn't work in communist countries, let alone our country. obama is a disaster; he makes Jimmy Carter look like George Washington. Some day you'll get it, I hope. -

BoatShoes

Well I don't disagree that President Obama probably wasn't qualified to be President...the ideas of the parties are what really counts domestically as President Obama has been serviceable in foreign policy.Manhattan Buckeye;1253539 wrote:Barack Obama = Joe Bauserman multiplied by Austin Mocherman to the Steve Bellasari's power. He hasn't just been bad, he's terrible regardless of whether you believe in his politics. He's an unaccomplished person that was lifted to POTUS because of anti-Bush sentiment and super-leftists opening doors to him right and left without opposition. Now there is opposition. The guy has done a poor job. And Biden, my god......

The fact that you would vote for Romney because he was a successful private equity manager and Barack Obama was largely unaccomplished even when we know from the evidence that the policies proposed by the accomplished person will make things worse.

I'm sorry but disliking President Obama isn't a good excuse for not voting for him. The evidence is clear that the state budget cuts by the party you're going to vote for has reduced GDP and raised unemployment. Without that, we'd be approaching full employment and growing at a faster rate. -

BoatShoes

Well, you didn't answer the question. You say that the unemployment compensation is a handout. Ok fine but things like that are why the budget deficit is so high along with historically low revenues as a percentage of gdp due to high unemployment.QuakerOats;1253668 wrote:Businesses pay unemployment compensation through U/C taxes, and then through higher U/C taxes after they have had layoffs and must replenish their balances (state and federal). We have thrown an extra $1.3 trillion per year in federal spending for 4 years now, but instead of directing it in a way to instill confidence we have done the opposite. It is simply a handout and in effect a declaration from the obama team that "we have no idea what we are doing, we have no plan for growth, we have no tax reform, we are heaping more and more and more regulations and laws at businesses, and we cannot instill any sense of confidence in the economy, so we are just going to give the incremental unemployed and public sector unions trillions of dollars and hope we get elected again".

Some of us could quickly reduce spending and put forth a plan that would indeed balance the budget and begin to reduce the debt. We simply have the WRONG PEOPLE running the show right now and NOTHING IS GOING TO GET BETTER until there is a change in the White House and then in every cabinet position on down the line.

You cannot run a captialist economy with a communist policy agenda; heck communist policy doesn't work in communist countries, let alone our country. obama is a disaster; he makes Jimmy Carter look like George Washington. Some day you'll get it, I hope.

You say you could quickly cut spending and get to a balanced budget. How do you cut the types of spending causing the increase in the budget deficit (unemployment insurance and food stamps) without taking money out of people's pockets and therefore causing unemployment to go higher and consequently revenue to drop further...leading to a budget deficit, despite the pursuit of a balanced budget.

Even the GOP is arguing that the spending cuts on the horizon that will reduce the deficit will reduce gdp and put us in recession. Do you disagree with this?

(And for what it's worth, Mitt Romney and Paul Ryan have both produced plans that will be deficit exploding...however they want to run large deficits with policies that have low multipliers...so not sure how you can say with a straight face that the GOP will be getting any where near a balanced budget either). -

BoatShoes

Actually we have good ideas...more government spending financed by willing investors at historically low interest rates on needed construction projects with high multipliers. We know this works and have half a century. The stimulus package was the right medicine but the wrong dose. We could also use the same inflation rate Ronald Reagan had for the short term to reduce the real burden of our debt. Finally, we should give more aid to the states so they can hire back the people they've fired and contractors they've put on hold when they started the largest spending cuts since the demobilization after the Korean War which has prevented our economy from approaching full employment despite faster private sector job growth and investment than occurred following the previous two recessions.sjmvsfscs08;1253654 wrote:This basically is the third section of the campaign speech. You don't have any good ideas, so make people afraid of Mitt Romney. It's pretty damn weak.

Romney's ideas are the opposite...cutting government spending in pursuit of a balanced budget despite it's automatic rise due to the needs of the unemployed and falling tax revenue and despite record low interest rates indicating investors aren't worried about our ability to pay our obligations....all in the hope that it will engender enough "confidence" that the private sector will consume and spend instead of the government.

That is a folly and you will be worse off like every other country is who has tried it. Be careful what you wish for. -

BoatShoes

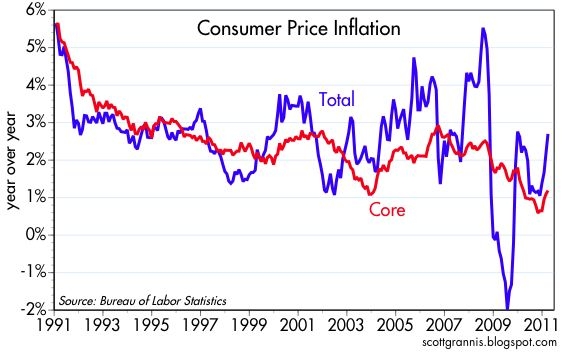

I don't entirely disagree.....but....IggyPride00;1253587 wrote:Core inflation is a complete joke, and not something to be basing money printing decisions off of in 2012.

Food, energy, tuition, healthcare costs, and commodities are all well over the 2% rate of inflation the Fed targets. Those are things that normal people use and deal with on a daily basis. They are all up, up and away right now.

When you strip out food and energy of course the number is below the target.

So you really think that printing more money is going to help? They are already at the zero bound on interest rates, they have driven down mortgage rates almost as far as they can go? What exactly is turning on the printing presses going to do?

It seems to me to be a formula to just continue to drive asset prices higher and make things more expensive for middle class people without adding jobs or helping the broader economy. It will continue to help line Wallstreet's pockets as QE1 and 2 did, but it does nothing to help create jobs at this point.

The longer we operate in a 0% interest rate environment the harder it is ever going to be to get off it. It is not realistic, but you have financial institutions that are so dependent on it for their business model now that they will be unwilling to see the economy improve in a way that takes it away. It is a perverse incentive to keep things stagnant. Corporate profits have never been higher, and the worse things get the more freebies they get.

They have already largely discounted the effect QE3 is going to have, and the second it happens the clamoring for QE4 will begin. It's like giving a heroin addict a huge stash and telling them to make it last. They can't, and will be looking for the next score before they have even come down off the initial high.

I suppose we should have made monetary policy based upon those huge swings in headline inflation despite its tracking core inflation...

For what it's worth, I believe personally that Monetary Policy has nearly met it's wits end at the zero bound and this is the proper time for a fiscal stimulus. However, given Congress' greater interest in getting the president out of office hoping that this will impress the "confidence fairy" rather than follow basic macro, I think the Federal Reserve should try something...anything...to try and do its job of getting unemployment back near full employment. -

QuakerOatsBoatShoes;1253681 wrote:Well, you didn't answer the question. You say that the unemployment compensation is a handout. Ok fine but things like that are why the budget deficit is so high along with historically low revenues as a percentage of gdp due to high unemployment.

You say you could quickly cut spending and get to a balanced budget. How do you cut the types of spending causing the increase in the budget deficit (unemployment insurance and food stamps) without taking money out of people's pockets and therefore causing unemployment to go higher and consequently revenue to drop further...leading to a budget deficit, despite the pursuit of a balanced budget.

Even the GOP is arguing that the spending cuts on the horizon will reduce gdp and put us in recession. Do you disagree with this?

I did answer the question. The budget deficit is not out of whack because of unemployment compensation. UC is PAID FOR by business contributions to the UC funds (state and federal). As business have had layoffs their UC contributions have risen, often substantially, to pay for the UC benefits. It is the radical increases in federal spending, far beyond any incremental UC spending, that are hurting us, and enslaving us to government for as far as the eye can see. But, this is exactly what obama wants -- millions and millions relying on him to take from the few taxpayers and give to the non-productive so he can retain power, and continue his unprecedented growth of BIG government, and, as he said "fundamentally transform" this nation.

The election is basically about one thing: BIGGER GOVERNMENT and enslavement, or smaller government and economic freedom. -

BoatShoes

I was using it as an example...unemployment, food stamps, more people in medicaid, plus historically low tax revenue are your additional billions increasing the deficit above a trillion dollars. The CBO agrees that this type of spending is not a threat to our long run budget picture (unlike health care costs). This radical and permanent increase in the size of government is imaginary and you claiming you'd have a balanced budget that wouldn't throw us into a deep recession is laughable.QuakerOats;1253698 wrote:I did answer the question. The budget deficit is not out of whack because of unemployment compensation. UC is PAID FOR by business contributions to the UC funds (state and federal). As business have had layoffs their UC contributions have risen, often substantially, to pay for the UC benefits. It is the radical increases in federal spending, far beyond any incremental UC spending, that are hurting us, and enslaving us to government for as far as the eye can see. But, this is exactly what obama wants -- millions and millions relying on him to take from the few taxpayers and give to the non-productive so he can retain power, and continue his unprecedented growth of BIG government, and, as he said "fundamentally transform" this nation.

The election is basically about one thing: BIGGER GOVERNMENT and enslavement, or smaller government and economic freedom.

And, for what it's worth, if the Paul Ryan budget were to come to pass...if I had grown up under that, I would have had less economic freedom than I did. -

BoatShoesBut it's going to be super sweet next week to listen to the GOP tell us about how great "small government" is from a building built by taxpayers for their taxpayer subsidized convention while they request Federal Emergency Management Funds for the hurricane that's going to ruin their big party.

-

QuakerOats90% of the trillion dollar plus deficits are due to dramtically increased spending, not revenues. We could give 15 million (unemployed) people $18,000 per year and that equates to $270 billion. Where is the other $1 TRILLION plus in new spending going? Revenues are now about where they were pre-crisis; spending should be there as well. And it could be, unless you are trying to buy union votes or forever enslave people to government dependency.

-

QuakerOatsBoatShoes;1253716 wrote:But it's going to be super sweet next week to listen to the GOP tell us about how great "small government" is from a building built by taxpayers for their taxpayer subsidized convention while they request Federal Emergency Management Funds for the hurricane that's going to ruin their big party.

FEMA is a joke and should be eliminated, with some of the services then farmed out to private entities. Wal Mart delivered needed goods 20 times faster than FEMA could ever imagine during Katrina. Then again, solutions derived from the private sector always trump government, exponentially. -

BoatShoes

With an unemployment rate above 8%...unless you think food stamps, unemployment insurance and medicaid should be completely eliminated, federal spending automatically rises...and dramatically so for slumps as long as these. 90% of the increase in the deficit prior to pre-crisis years is either from less revenue due to Obama's tax cuts + Less revenue from slump...and, automatic increases in outlays on income security.QuakerOats;1253724 wrote:90% of the trillion dollar plus deficits are due to dramtically increased spending, not revenues. We could give 15 million (unemployed) people $18,000 per year and that equates to $270 billion. Where is the other $1 TRILLION plus in new spending going? Revenues are now about where they were pre-crisis; spending should be there as well. And it could be, unless you are trying to buy union votes or forever enslave people to government dependency.

These are the facts.

If you play with the CBO baselines to get the real world picture (i.e. keep bush tax cuts) you get a projection of revenue of around 2.93 trillion in 2011 but we got 2.30 trillion. A loss of 630 billion in revenue. You get a projection of 3.36 trillion in outlays but we have 3.60 trillion...an increase of 240 billion above projections...164 billion of which is income security spending.

So you've got about 76 billion of the increase in our deficit from the pre-crisis years attributable to your socialist fantasy.

But I suppose the anser to not having to worry about loss of revenue causing high deficits in recessions is to eliminate taxes on everything except wages and the answer to automatically rising income security spending is to eliminate security spending. That's what's great about recessions after all...it gets the rot out who can't hack it.

Here's some sources and a neat graph that sums it up correctly to me although I think the site seems questionable.

http://www.cbo.gov/publication/42905

http://www.cbo.gov/publication/41661

So maybe if you can finally agree on the facts...how are you going to cut those increased outlays and not depress revenue further, increase unemployment and thereby make any attempt at a balanced budget futile with the Federal Reserve nearly out of power and unemployment already staggeringly high?

***Site for graphs is ran by a lib it appears but the graphs seem to match the data that I find at the CBO links. -

BoatShoes

Whatever you say. But, it would definitely be iinteresting seeing FEMA come to the rescue of the rugged individualists hiding out from a Hurricane in their socialist stadium.QuakerOats;1253739 wrote:FEMA is a joke and should be eliminated, with some of the services then farmed out to private entities. Wal Mart delivered needed goods 20 times faster than FEMA could ever imagine during Katrina. Then again, solutions derived from the private sector always trump government, exponentially. -

QuakerOatsBoatShoes;1253840 wrote: 90% of the increase in the deficit prior to pre-crisis years is either from less revenue due to Obama's tax cuts + Less revenue from slump...and, automatic increases in outlays on income security.

These are the facts.

So maybe if you can finally agree on the facts...how are you going to cut those increased outlays and not depress revenue further, increase unemployment and thereby make any attempt at a balanced budget futile with the Federal Reserve nearly out of power and unemployment already staggeringly high?

Ahh yes, those pesky "facts". Let's see, complaing about revenue shortages because of the Bush tax cuts. Well, in 2003 revenue was $1.78 trillion, and in 2008 revenue was $2.52 trillion -- a whopping 42% increase in revenue, DUE TO THE BUSH TAX RATE CUTS. Thank you very much. As has happened every time marginal tax rates are cut --- overall revenue to the Treasury increases.

And now, in 2012, reveue is expected to be $2.62 trillion, the highest in our nation's history.

http://www.whitehouse.gov/sites/default/files/omb/budget/fy2012/assets/hist01z1.xls

The only problem is, since 2007 when spending was $2.7 trillion, we have increased spending to $3.7 trillion. This is an extra trillion per year, with no end in sight except for even further increases far beyond this extra trillion. Average spending under obama is 52% higher than under Bush. And obama is literally on track to double the size of the federal government in just 8 years in terms of spending. That is outrageous.

The reason the picture is so bleak under obama, and why unemployment is so staggeringly and persistently high, is because of everything else the obama regime is doing, all of which is putting the chill on investment, confidence, demand, and growth. There is only one way out of the mess, growth. But growth cannot occur in our economy when it is being doused with Marxist and communist policy. Sorry. -

jmogBoatshoes, you can bring up all the % GDP you want, but saying we are bringing in less revenue is factually incorrect UNLESS you say "less revenue if compared to GDP". You are just trying to use a statistical trick to make the facts appear different.

Lets look at ACTUAL money coming into the government. Please tell me, are we bringing in more now than we were during any of the Bush years? -

IggyPride00

Revenues were 2.025 Trillion in 2000, and in inflation adjusted dollars it took 6 years after the tax cuts to get back to that number. In nominal terms it was 4 years.Ahh yes, those pesky "facts". Let's see, complaing about revenue shortages because of the Bush tax cuts. Well, in 2003 revenue was $1.78 trillion, and in 2008 revenue was $2.52 trillion -- a whopping 42% increase in revenue, DUE TO THE BUSH TAX RATE CUTS. Thank you very much. As has happened every time marginal tax rates are cut --- overall revenue to the Treasury increases.

In the interim we just added to the deficit during the shortfall, so the tax cuts never really did pay for themselves because the growth in receipts never grew enough to pay for the debt incurred (including interest) during the years where revenues fall after the tax cuts.

If you are as interested in facts as you say you are you would have compared apples to apples on a revenue scale by accounting for inflation. You conveniently forgot to do that though it seems.

Adjusted for inflation tax receipts haven't risen a nickel in the past 12 years essentially, while spending has exploded.

I am not advocating for or against them, but there does need to be some intellectual honesty brought into the conversation which was missing in the numbers you guys were comparing. -

gut

What other significant economic development happened in 2000 that might have heavily influenced, even dominated, that stat?IggyPride00;1254106 wrote:Revenues were 2.025 Trillion in 2000, and in inflation adjusted dollars it took 6 years after the tax cuts to get back to that number. In nominal terms it was 4 years.

There's no debating that prior to 2000, and Clinton's ability to "balance" the budget as a result, revenues were artificially inflated by the dot-com bubble. -

gutBoatshoes posted the relevant graph to look at, which is taxes as a % of GDP. Historically this has averaged @18.2%, and remarkably consistent across pretty drastically different tax policies.

The two dips are interesting. But take note: taxes on investment income (ordinary and capital gains) are pretty big pieces of that pie. Corporate earnings, as well. And those two huge market corrections we saw created lots of offsets to income, ordinary and long-term, as well as capital loss carry forwards. It takes time for that to work its way out of the tax system for the bases to rise to more normative levels.