Obama (hint) to create jobs.

-

BoatShoes

Apologies for the spelling and grammatical errors. When I post during work hours I have to post quickly. Obama's inadequate stimulus was predicted to create 3.5 million jobs...partially because Christina Romer is more sympathetic towards the stimulative effects of targeted tax relief based upon her research. The CBO reports that the net effect of job creation when taking into account extended working hours was in that range. I've provided evidence from a respected source suggesting that the Recovery Act has kept unemployment 1.6% points lower than it otherwise would be...that is unemployment would still be above 10% and we'd already be in a double dip recession if we ever even would have left the original contraction.jmog;886888 wrote:Probably the shortest post you have ever put up and you still ramble an incoherent response filled with big words to try to make yourself look smart.

Please tell me something, the last stimulus that was a huge amount, that was supposed to create these same type of jobs that Obama will be saying that the new one will create. How did well this stimulus work? The Keynesian economic plans you so desperately cling to BoatShoes was a piece of crap the last time Obama put through a stimulus. How is the American people to believe the exact same philosophy will work this time?

You know, the definition of insanity is doing the same thing over and over again and expecting different results.

You on the other hand have offered an assertion that it was "keynesian crap" without a foundation. I have provided evidence based upon available economic data that it was not large enough to fill the 6% contraction in gdp caused by the housing collapse and the rapid draw down in consumer spending. You have provided nothing. You are an engineer. You are supposed to rely on empirical evidence for the opinions you adhere to and you have done nothing of the sort in the post I am quoting. I have said all along that contractionary economic policies like deficit reduction, whether by tax raises or spending cuts will indeed cause further economic contraction. The austerity policies of the Eurozone and the United States (including the inadequate stimulus in 2009) are preventing an economic recovery.

And, what do you know, the United Nation's released a report saying just that. http://www.nytimes.com/2011/09/07/world/europe/07nations.html

I'm sure your busy so in case you don't read it, here's the opening sentence. "The global economy faces a decade-long stagnation because governments are pursuing deficit cuts and other austerity measures rather than providing the needed stimulus packages, said a United Nations economic report released Tuesday."

If you're so inclined, you can read the real report here: http://www.unctad.org/Templates/WebFlyer.asp?intItemID=6057&lang=1 -

Cleveland Buck

The Keynesian fluff and working the dog shit out of the printing press can prop up some macroeconomic numbers and even create some jobs even though they are either temporary or unsustainable jobs. All it does though is dig the hole deeper. It doesn't solve anything.

The Keynesian fluff and working the dog shit out of the printing press can prop up some macroeconomic numbers and even create some jobs even though they are either temporary or unsustainable jobs. All it does though is dig the hole deeper. It doesn't solve anything.

This whole idea that growth is based on demand is a fallacy. There is always demand. It's just a matter of the price. Growth is based on capital, and inflating away savings and misdirected government spending is exactly the way you eliminate the capital you need for sustainable economic growth.

Prices of everything should be falling right now, but instead they are rising. Wages should be falling to keep people working. Instead we prop up wages costing millions of people a job at all.

Interest rates are the measure of the demand for money. Right now we have no savings and everyone wants to borrow, so interest rates should be sky high to discourage borrowing and encourage savings. Instead in Federal Reserve is holding interest rates at zero so banks can make a living buying treasury bills until that market collapses.

The bankers are happy, they get their handouts. Everyone else who pays higher prices for food and gas while making less money or none at all can go fuck themselves.

The Fed has already pumped $16 trillion into the global economy over the last few years, most of that in this country. The government is already running $1.6 trillion in deficits. I don't know what magical Keynesian trick they can try now that will all of a sudden work. They might create 100,000 temporary jobs and they can massage the numbers to make it look it we should do more of it again next year. The malinvestment from years of easy money and government direction is so entrenched that this economy will never grow on it's own again without letting a severe correction happen. We are going to bankrupt ourselves trying to save the central planners when a free market is what made this country a superpower in the first place. -

BoatShoes

Funny you say this. From commentary on the U.N. report on the harmful effects of global austerity;QuakerOats;886572 wrote:After all, it is only demand that can create a job.

“If you have no demand, then you need government to step in with a huge program for stimulating the economy,” Mr. Flassbeck, a former deputy finance minister in Germany, told reporters, according to Reuters.

But carry on I suppose...it'd be funny I guess were it not for the consequences of ideas. -

Manhattan Buckeye"This whole idea that growth is based on demand is a fallacy. There is always demand. It's just a matter of the price."

This is 100% correct, I was involved with a conversation with a family friend who's stance was "how could anyone be unemployed", that is, if someone knows how to play piano, they can teach piano, if someone has the ability to mow lawns, they should be able to mow lawns.

Leaving outside the regulatory issues for certain trades (one can't even be an interior designer without being licensed in some jurisdictions), it is a silly viewpoint, obviously we could all use various services, the question is the ability as well as the willingness to pay for it. I could play the piano like Little Richard but if my potential customers can't afford to pay me for lessons my talent isn't going to bring in any revenue. -

believer

The major problem with Flassbeck's belief is that government stimulus (which has proven time and again to be a failure) is always at someone else's expense. It never creates wealth. It only sucks it from one segment of the economy and redistributes it to another.BoatShoes;887036 wrote:Funny you say this. From commentary on the U.N. report on the harmful effects of global austerity;

“If you have no demand, then you need government to step in with a huge program for stimulating the economy,” Mr. Flassbeck, a former deputy finance minister in Germany, told reporters, according to Reuters.

But carry on I suppose...it'd be funny I guess were it not for the consequences of ideas. -

queencitybuckeye

My question simply required a yes or no answer. Do you have a mental or emotional infirmity that requires you to use fifty words when one will actually communicate more clearly?BoatShoes;887005 wrote:Look you're a big boy, this is the conclusion of economists using conventional macro-economic models. Using mainstream economic tools they've determine the recovery act kept they unemployment rate down by as high as 1.6% points. You can read their evidence and methodology here. It's only a 9 page report. I imagine I'll rely on credible economists to formulate what opinions I'm inclined to sympathize toward. http://cbo.gov/ftpdocs/123xx/doc12385/08-24-ARRA.pdf

The interesting number that comes out of the report is $700,000,000,000 (850B * 85%) divided by 4,000,000 = $175,000 per job created/"saved" (and this is using the most optimistic figure, at the low end of their estimate, it's a cool half million per job). Yes, a great investment. SMH. -

Belly35

Reminder the term "Global" is Liberal catch word for fraud.. Anything after the word "Global" is meaninglessBoatShoes;887036 wrote:Funny you say this. From commentary on the U.N. report on the harmful effects of global austerity;

“If you have no demand, then you need government to step in with a huge program for stimulating the economy,” Mr. Flassbeck, a former deputy finance minister in Germany, told reporters, according to Reuters.

But carry on I suppose...it'd be funny I guess were it not for the consequences of ideas. -

Writerbuckeye

Cleveland Buck;887035 wrote:The Keynesian fluff and working the dog **** out of the printing press can prop up some macroeconomic numbers and even create some jobs even though they are either temporary or unsustainable jobs. All it does though is dig the hole deeper. It doesn't solve anything.

Cleveland Buck;887035 wrote:The Keynesian fluff and working the dog **** out of the printing press can prop up some macroeconomic numbers and even create some jobs even though they are either temporary or unsustainable jobs. All it does though is dig the hole deeper. It doesn't solve anything.

This whole idea that growth is based on demand is a fallacy. There is always demand. It's just a matter of the price. Growth is based on capital, and inflating away savings and misdirected government spending is exactly the way you eliminate the capital you need for sustainable economic growth.

Prices of everything should be falling right now, but instead they are rising. Wages should be falling to keep people working. Instead we prop up wages costing millions of people a job at all.

Interest rates are the measure of the demand for money. Right now we have no savings and everyone wants to borrow, so interest rates should be sky high to discourage borrowing and encourage savings. Instead in Federal Reserve is holding interest rates at zero so banks can make a living buying treasury bills until that market collapses.

The bankers are happy, they get their handouts. Everyone else who pays higher prices for food and gas while making less money or none at all can go **** themselves.

The Fed has already pumped $16 trillion into the global economy over the last few years, most of that in this country. The government is already running $1.6 trillion in deficits. I don't know what magical Keynesian trick they can try now that will all of a sudden work. They might create 100,000 temporary jobs and they can massage the numbers to make it look it we should do more of it again next year. The malinvestment from years of easy money and government direction is so entrenched that this economy will never grow on it's own again without letting a severe correction happen. We are going to bankrupt ourselves trying to save the central planners when a free market is what made this country a superpower in the first place.

-

QuakerOats

A) - Your first two sentences are completely false.BoatShoes;886652 wrote:Unsurprisingly you are incorrect again. I am sure you must work for the Republican party at this point as it's the only thing that can explain your party line rigidity.

Your view that the Bush Tax Cuts did NOT cause a loss in revenue is not the view shared by either Republican economists nor empirical evidence.

Your claim that we bring in more revenue as a percentage GDP in 2011 as opposed to 2004...is patently and utterly false...and we never brought in as much revenue as we did in 2000 and we barely screeched above the historical average in 2006.

B) - My view of the Bush tax cuts is fully supported by the ACTUAL receipts to federal treasury: in 2003 $1.782 trillion; in 2010 $2,165 trillion ---- an increase of 21% over 7 years, exactly as stated in my post. If you really have a hard time with that, then perhaps you remember this math from elementary school: 2,165,000,000,000 > 1,782,000,000.

C) - my claim was NEVER about revenue as a percentage of GDP, so please refrain from putting words in my mouth. Everyone knows in a massive recession exacerbated by leftist policies that cause unemployment to be near depression levels that revenue as a percent of GDP will suffer. But that is a completely moot point that has no bearing on the proper formula for fixing the mess; it is only a talking point of liberals who want to tax the upper classes more and allow the bottom 50% to contribute NOTHING toward anything. Bush managed through 2 recessions, 9/11, and Katrina, and at the same time garnered more revenue to the Treasury because of cuts in marginal rates that spurred growth and added millions of jobs (i.e. more taxpayers). The record speaks for itself, despite the attempts by you revisionists, liberal apologists, and W haters to manufacture false claims.

As a result, all of your major assertions leveled at me are completely untrue, and the record bears that out. Sorry to burst your bubble. -

QuakerOats

That is so incredibly laughable one hardly knows where to start. We are crashing and burning because we have overspent for 50 years, and the answer is to deficit-spend more. Only in the utopian world of UN socialists could such a statement emanate from, with the exception of the marxist now occupying the White House.BoatShoes;887014 wrote: And, what do you know, the United Nation's released a report saying just that. http://www.nytimes.com/2011/09/07/world/europe/07nations.html

I'm sure your busy so in case you don't read it, here's the opening sentence. "The global economy faces a decade-long stagnation because governments are pursuing deficit cuts and other austerity measures rather than providing the needed stimulus packages, said a United Nations economic report released Tuesday."

Hell, if that were the answer let's just print $20 trillion tomorrow and we'll all be saved.

God Almighty this is getting hard to believe. -

QuakerOats

Just one? http://www.census.gov/compendia/statab/2011/tables/11s0467.pdfFootwedge;886990 wrote:There is no way that Oats can possibly believe that Bush's tax cuts somehow increased revenues. There is no effin way. I would like to see one lousy stinking link....anywhere...in the whole wide internet...that substantiates such a ludicrous claim.

'03 - $1.782 trillion

'04 - $1.880 trillion

'05 - $2.153 trillion

'06 - $2,406 trillion

'07 - $2,568 trillion

'08 - $2,524 trillion (beg. recession)

And, not only did revenue rise nearly every year, we were adding millions of jobs.

The facts are there, you just have to want to actually see them. -

QuakerOats

One final point regarding tax receipts and GDP, you will note in 2007 a few years into those bad Bush tax cuts, that revenues, even as a percent of GDP, were 18.5% --- God Forbid. Well guess what, as the chart in my link details, the average througout those great Clintion 1990's was 18.49%. Amazing isn't it.BoatShoes;886652 wrote:Your claim that we bring in more revenue as a percentage GDP in 2011 as opposed to 2004...is patently and utterly false...and we never brought in as much revenue as we did in 2000 and we barely screeched above the historical average in 2006.

The Office of Managment and Budget erroneously predicted tax revenue would rise thinking we'd be out of the recession and growing robustly again but we're still hovering around 14.5% of GDP.

Now get back to more revisionism and the time-tested, proven failure of Keynesian 'theory'. Good luck. -

BoatShoes

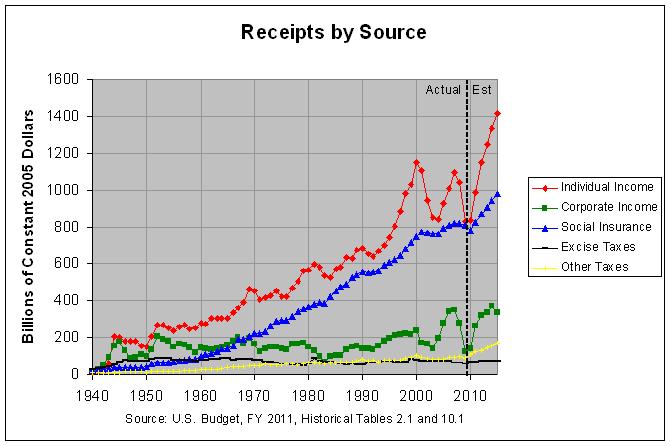

I brought up tax receipts as a percentage of GDP because your point about overall increases in tax receipts is of no consequence. Individual Tax Receipts overall have doubled during EVERY SINGLE DECADE SINCE THE GREAT DEPRESSION! They went up 502.4% during the 40's, 134.5% during the 50's, 108.5% during the 60's, and 168.2% during the 70's. At 96.2 percent, they nearly doubled in the 90s as well. Hence, claiming that the Bush taxcuts caused the doubling of revenues is akin to A ROOSTER CLAIMING CREDIT FOR THE DAWN.QuakerOats;887186 wrote:A) - Your first two sentences are completely false.

B) - My view of the Bush tax cuts is fully supported by the ACTUAL receipts to federal treasury: in 2003 $1.782 trillion; in 2010 $2,165 trillion ---- an increase of 21% over 7 years, exactly as stated in my post. If you really have a hard time with that, then perhaps you remember this math from elementary school: 2,165,000,000,000 > 1,782,000,000.

C) - my claim was NEVER about revenue as a percentage of GDP, so please refrain from putting words in my mouth. Everyone knows in a massive recession exacerbated by leftist policies that cause unemployment to be near depression levels that revenue as a percent of GDP will suffer. But that is a completely moot point that has no bearing on the proper formula for fixing the mess; it is only a talking point of liberals who want to tax the upper classes more and allow the bottom 50% to contribute NOTHING toward anything. Bush managed through 2 recessions, 9/11, and Katrina, and at the same time garnered more revenue to the Treasury because of cuts in marginal rates that spurred growth and added millions of jobs (i.e. more taxpayers). The record speaks for itself, despite the attempts by you revisionists, liberal apologists, and W haters to manufacture false claims.

As a result, all of your major assertions leveled at me are completely untrue, and the record bears that out. Sorry to burst your bubble.

You could make the same argument you're making about Clinton and Bush 41's tax increases...that they increased individual income tax receipts but it would wrong as well. Tax Receipts as a percentage of GDP are the name of the game.

-

BoatShoes

Tax receipts as a percentage of GDP were below the historical average in aver year of his presidency but one and directly following the Bush tax cuts in 2001 they plummeted below the historical average. I mean, what do you have to say about all of those Republican economists I quoted who are agreeing with me? Why do the Chairs of President Bush's economic teams agree with me and not you?QuakerOats;887230 wrote:One final point regarding tax receipts and GDP, you will note in 2007 a few years into those bad Bush tax cuts, that revenues, even as a percent of GDP, were 18.5% --- God Forbid. Well guess what, as the chart in my link details, the average througout those great Clintion 1990's was 18.49%. Amazing isn't it.

Now get back to more revisionism and the time-tested, proven failure of Keynesian 'theory'. Good luck. -

BoatShoes

Hey there, no need to bring in my emotional infirmities as that hurts my feelings. Apologies for not answering in the way you demand of me 'masa. I guess I just thought if I merely said "yes" you wouldn't give yourself the opportunity to critically evaluate why it might be more proper not to automatically discount the methodology of people who do Econ for a living and remain committed to your own preconceived worldview. My mistake.queencitybuckeye;887090 wrote:My question simply required a yes or no answer. Do you have a mental or emotional infirmity that requires you to use fifty words when one will actually communicate more clearly?

The interesting number that comes out of the report is $700,000,000,000 (850B * 85%) divided by 4,000,000 = $175,000 per job created/"saved" (and this is using the most optimistic figure, at the low end of their estimate, it's a cool half million per job). Yes, a great investment. SMH. -

QuakerOats

Amazing how that happened despite Kennedy's tax cuts, Reagan's tax cuts, and Bush's tax cuts. Just amazing.BoatShoes;887273 wrote:I brought up tax receipts as a percentage of GDP because your point about overall increases in tax receipts is of no consequence. Individual Tax Receipts overall have doubled during EVERY SINGLE DECADE SINCE THE GREAT DEPRESSION! They went up 502.4% during the 40's, 134.5% during the 50's, 108.5% during the 60's, and 168.2% during the 70's. At 96.2 percent, they nearly doubled in the 90s as well. Hence, claiming that the Bush taxcuts caused the doubling of revenues is akin to A ROOSTER CLAIMING CREDIT FOR THE DAWN.

Carry on. -

queencitybuckeye

These people who "do Econ for a living" wrote in their report that each job "created" cost somewhere between $175-500K. Based on this, the term I used for the stimulus, abject failure, is at the very least accurate, and at most understated. Thanks for the confirmation.BoatShoes;887282 wrote:Hey there, no need to bring in my emotional infirmities as that hurts my feelings. Apologies for not answering in the way you demand of me 'masa. I guess I just thought if I merely said "yes" you wouldn't give yourself the opportunity to critically evaluate why it might be more proper not to automatically discount the methodology of people who do Econ for a living and remain committed to your own preconceived worldview. My mistake. -

BoatShoes

This is demonstrably not true. Please review Adam Smith's The Wealth of Nations. A wealthier society is one where people are better off in various life measures. It's not about who has the most nominal dollars, otherwise we could all get rich by printing money. All you need to create wealth is people working together in some way to create a better outcome than there was before; a more productive combination of resources from productivity that increases the well-being of society...it is what the social contract is all about; that life is better if we contract away some of fundamental liberty and contract together in mutual cooperation so that we might prosper more fully.believer;887077 wrote:The major problem with Flassbeck's belief is that government stimulus (which has proven time and again to be a failure) is always at someone else's expense. It never creates wealth. It only sucks it from one segment of the economy and redistributes it to another.

For example, a police force that reduces crime and makes the public safer creates wealth. A prison creates wealth by keeping said criminals away from the public. Courts create wealth by enforcing contracts and tort liability, etc. The private sector frequently does things a lot better than the public sector but there are times, like now, when the private sector is awash in capacity, hording cash and not using millions of willing and able bodies and we can borrow for free that the public sector can play a vital role.

The government also created wealth when it built the Erie Canal. That is perhaps my favorite example. The state of New York went into tremendous debt after the private sector failed at a similar task and went on to create one of the largest arteries for wealth creation in human history. It is largely responsible for the burgeoning of New York as an economic powerhouse. It cemented the victory of Hamilton's view of America as an economic mecca over Jefferson's desire for a world of yeomen farmers. -

BoatShoes

You are confusing the cause of the tax receipt increase as being national tax policy and not the long run growth rate...QuakerOats;887284 wrote:Amazing how that happened despite Kennedy's tax cuts, Reagan's tax cuts, and Bush's tax cuts. Just amazing.

Carry on. -

BoatShoes

Well when that cost is spread out over multiple years and you take into account that only about 500 billion of the Act was direct spending that is not so crazy. The fact is that more people would be unemployed, we'd have lower economic growth and less economic prosperity than we even do know how the Recovery Act not been passed.queencitybuckeye;887296 wrote:These people who "do Econ for a living" wrote in their report that each job "created" cost somewhere between $175-500K. Based on this, the term I used for the stimulus, abject failure, is at the very least accurate, and at most understated. Thanks for the confirmation. -

QuakerOats

To foster growth you need the ability for capital formation, as capital always flows to where it's treated best. Thus capital has, in many measures, offshored itself to environments of low taxation and low regulation. Given that those two items are antithetic to the obama regime, we have what we have.BoatShoes;887302 wrote:You are confusing the cause of the tax receipt increase as being national tax policy and not the long run growth rate... -

queencitybuckeye

It's totally crazy. It's no different than the concept of printing money to make everyone a millionaire. Let's just spend our way to full employment. :rolleyes:BoatShoes;887305 wrote:Well when that cost is spread out over multiple years and you take into account that only about 500 billion of the Act was direct spending that is not so crazy. The fact is that more people would be unemployed, we'd have lower economic growth and less economic prosperity than we even do know how the Recovery Act not been passed. -

PrescottIs this an example of stimulus money well spent??

In 2009, Solyndra secured a $535 million loan guarantee from the U.S. Treasury to produce solar panels. But on August 31, 2011, the company shut its doors and announced its intent to file for bankruptcy.

The revelation came after President Obama visited the plant in May 2010 and touted it as a shining light for the future of green jobs and a green-energy economy.

“The promise of clean energy isn’t just an article of faith — not anymore,” Obama said at the time. “The future is here.”

The future was bankruptcy.

[LEFT][/LEFT] -

QuakerOats

Disagree. A job should not "cost" anything, if it does, it is not needed. We did not need the failure of propping up expendable jobs (largely in the inefficient public sector). Those jobs need to go by the wayside and resources reallocated to unleash innovation, which is the only way to true wealth creation. The sooner we move in that direction with a real fiscal policy to stablize our dangerous debt situation the better. But that apparently will not happen under this regime so our only hope is to survive until Nov '12.BoatShoes;887305 wrote:Well when that cost is spread out over multiple years and you take into account that only about 500 billion of the Act was direct spending that is not so crazy. The fact is that more people would be unemployed, we'd have lower economic growth and less economic prosperity than we even do know how the Recovery Act not been passed. -

QuakerOats

Solved. Let's go drinking!!queencitybuckeye;887320 wrote:It's no different than the concept of printing money to make everyone a millionaire. Let's just spend our way to full employment. :rolleyes: