Total government spending exceeds median household income.

-

jmog

Then you misunderstood what I said. I said that the fact that the government COULD tax 100% and still not have enough to operate (read balance the budget of all government levels) and you believe this would have no consequences is sad.BoatShoes;1428121 wrote:No you said that I suggested that 100% taxation wouldn't have any consequences which I never said anything about taxes. You didn't say anything about the level of government spending. Read your post again.

You said "100% taxation would still not give teh gubmint enough money to operate!?!?" Which shows, necessarily that you didn't understand because the government with a fiat currency necessarily always has enough money to operate as it is just a spreadsheet entry away. You wouldn't have written what you wrote if you grasped this.

Basically, it put it simpler, I can't believe you think that the original topic (total government spending is higher than total income of the US) has no consequences. -

BoatShoesAnd besides, I and FDR and Hubert Humphrey style liberals have always believed in eliminating the hodge podge welfare state here and in Europe and replacing it with New Deal style full employment programs...but the deficit scolds would never have it!

-

BoatShoes

Well First, you are incorrect, taxing 100% of national income would be enough to pay off the national debt so you are just factually incorrect. Obviously it would be disastrous for other reasons as it would collapse the economy and aggregate demand and cause disastrous supply problems but the point remains that you're simply factually incorrect.jmog;1428255 wrote:Then you misunderstood what I said. I said that the fact that the government COULD tax 100% and still not have enough to operate (read balance the budget of all government levels) and you believe this would have no consequences is sad.

Basically, it put it simpler, I can't believe you think that the original topic (total government spending is higher than total income of the US) has no consequences.

But, to the original topic at hand, you are wrong again...government spending is not higher than the total income of the united states. Gross National Income is like $16 trillion.

The thread title is how it is higher than Median National Income. So, maybe you just mis-typed. What are the negative consequences? Taking employees away from the Private Sector? No, there are upwards of 25 million people who are unable to sell their labor to private employers or who's labor is not demanded by private employers. Rise in interest rates? Countries with Fiat Currencies all over the world have ran record budget deficits and their interest rates have only gone lower. Hyperinflation/Hyper Increase in the Price Level if We're using Austrian Terms? No, Expected Inflation is below the Fed's target rate for a decade despite a massive increase in the money supply.

In fact, more government spending/injection of U.S. dollars into the hands of ordinary American's through expansionary fiscal policy...i.e. huge tax rebates, tax reductions or large government purchases of goods and services actually only has good consequences when the private sector is trying to save.

It is very simple, The Foreign Sector has a net surplus of dollars from us and the non-government sector desires to save/have a surplus as well. The state government and local government sector is also seeking to net save/have a surplus...even liberal california is on a path to a surplus. Operationally, the Federal government simply cannot run a surplus or a balanced budget under those conditions. It is impossible without causing a depression. It's just like saying that not all countries cannot run a trade surplus at the same time. -

jmog

Incorrect.BoatShoes;1428278 wrote:Well First, you are incorrect, taxing 100% of national income would be enough to pay off the national debt so you are just factually incorrect. Obviously it would be disastrous for other reasons as it would collapse the economy and aggregate demand and cause disastrous supply problems but the point remains that you're simply factually incorrect.

But, to the original topic at hand, you are wrong again...government spending is not higher than the total income of the united states. Gross National Income is like $16 trillion.

The thread title is how it is higher than Median National Income. So, maybe you just mis-typed. What are the negative consequences? Taking employees away from the Private Sector? No, there are upwards of 25 million people who are unable to sell their labor to private employers or who's labor is not demanded by private employers. Rise in interest rates? Countries with Fiat Currencies all over the world have ran record budget deficits and their interest rates have only gone lower. Hyperinflation/Hyper Increase in the Price Level if We're using Austrian Terms? No, Expected Inflation is below the Fed's target rate for a decade despite a massive increase in the money supply.

In fact, more government spending/injection of U.S. dollars into the hands of ordinary American's through expansionary fiscal policy...i.e. huge tax rebates, tax reductions or large government purchases of goods and services actually only has good consequences when the private sector is trying to save.

It is very simple, The Foreign Sector has a net surplus of dollars from us and the non-government sector desires to save/have a surplus as well. The state government and local government sector is also seeking to net save/have a surplus...even liberal california is on a path to a surplus. Operationally, the Federal government simply cannot run a surplus or a balanced budget under those conditions. It is impossible without causing a depression. It's just like saying that not all countries cannot run a trade surplus at the same time.

Straight from the US Census Bureau. There are about 115 million households in the US. The mean (average, not median) household income is about $69k/yr.

Do the multiplication, that is slightly less than $8 trillion in total household income in the US.

Less than half of what you said.

The total government spending is around $6 trillion, $3.5 trillion from the federal alone. That per household is $52k, higher than the $50k median, but a a little less than the $69k average.

So, the 100% tax analogy was a little off, to be 100% correct in my quick reply I should have said 75%. That is still astromical and stupidly retarded.

But keep up with your appeal to authority fallacies, historian's fallacies, and appeal to ridicule fallacies, they are working well for you. -

Manhattan Buckeye"even liberal california is on a path to a surplus."

Is that why they just offered another debt offering? -

BoatShoes

Read your post that I quoted again Jmog. You said "Total Household Income"...Not "Total Median Household Income" as is the thread topic. I addressed that.jmog;1428301 wrote:Incorrect.

Straight from the US Census Bureau. There are about 115 million households in the US. The mean (average, not median) household income is about $69k/yr.

Do the multiplication, that is slightly less than $8 trillion in total household income in the US.

Less than half of what you said.

The total government spending is around $6 trillion, $3.5 trillion from the federal alone. That per household is $52k, higher than the $50k median, but a a little less than the $69k average.

So, the 100% tax analogy was a little off, to be 100% correct in my quick reply I should have said 75%. That is still astromical and stupidly retarded.

But keep up with your appeal to authority fallacies, historian's fallacies, and appeal to ridicule fallacies, they are working well for you.

You are using different terminology from post to post that have distinct meanings and I have tried to address both of those points. But, to address the point again, as I said originally, saying that the People of the United States through their agents in government spend more than total median income is one of those stats that causes conservatives to want to invest in a bunch of gold bars but it really doesn't mean anything.you think that the original topic (total government spending is higher than total income of the US -

BoatShoes

Surely you can't mean that because they had a debt offering in April does not mean that they're not on the path to a budget surplus this year can you?Manhattan Buckeye;1428311 wrote:"even liberal california is on a path to a surplus."

Is that why they just offered another debt offering?

http://www.bloomberg.com/news/2013-04-11/california-sells-38-of-2-billion-issue-to-individuals.html

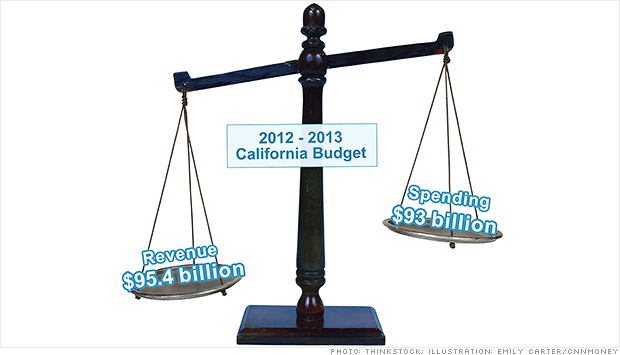

"Big Taxes + Spending Cuts = California Budget Surplus"...Brown, who backed the tax increases to fund education, said in January that California would have an $851 million budget surplus at the end of June, its first in more than a decade.

http://money.cnn.com/2013/02/07/news/economy/california-budget/index.html -

jmog

So the government spending 75% of the total income of the people of the country, has no consequences?BoatShoes;1428313 wrote:Read your post that I quoted again Jmog. You said "Total Household Income"...Not "Total Median Household Income" as is the thread topic. I addressed that.

You are using different terminology from post to post that have distinct meanings and I have tried to address both of those points. But, to address the point again, as I said originally, saying that the People of the United States through their agents in government spend more than total median income is one of those stats that causes conservatives to want to invest in a bunch of gold bars but it really doesn't mean anything. -

BoatShoes

It depends. The Federal Government which is the currency issuer, only causes good things to happen...that is has good consequences...when it places more U.S. dollars into the private economy and state and local government than it takes out through taxation so long as those dollars are used for real goods and services that otherwise would not be put to use....that is so long as too many dollars do not chase too few goods creating demand-pull inflation.jmog;1428360 wrote:So the government spending 75% of the total income of the people of the country, has no consequences?

A good example is to purchase the labor of otherwise idle people who are unable to sell their labor.

If we were at full employment and did not have excess capacity and more government injections of dollars into the real economy caused too many dollars to chase too few goods, under those conditions, we would have an increase in the price level that would be bad...so under those conditions there indeed would be negative consequences.

More to your point directly, it really depends on how much the non-government sector wants to save and how many dollars the foreign sector wants to hold. If 75% of our national income goes to foreigners and/or is saved by the private sector then generally only good consequences would result. -

jmog

So, in your mind since the federal government issues the money, there are ONLY good consequences of them spending $300 trillion dollars next year on/in the U.S.?BoatShoes;1428364 wrote:It depends. The Federal Government which is the currency issuer, only causes good things to happen...that is has good consequences...when it places more U.S. dollars into the private economy and state and local government than it takes out through taxation so long as those dollars are used for real goods and services that otherwise would not be put to use....that is so long as too many dollars do not chase too few goods creating demand-pull inflation.

A good example is to purchase the labor of otherwise idle people who are unable to sell their labor.

If we were at full employment and did not have excess capacity and more government injections of dollars into the real economy caused too many dollars to chase too few goods, under those conditions, we would have an increase in the price level that would be bad...so under those conditions there indeed would be negative consequences.

More to your point directly, it really depends on how much the non-government sector wants to save and how many dollars the foreign sector wants to hold. If 75% of our national income goes to foreigners and/or is saved by the private sector then generally only good consequences would result.

You can't be serious, there is no way you truly believe that the federal government spending ONLY causes good things, regardless of how much they spend. -

BoatShoes

Jmog. You are an intelligent guy. I did not say that there is no limit to what the government can spend. Read my post again. I did not say that the government say that the government could get away with $300 trillion in spending with no bad consequences.jmog;1428405 wrote:So, in your mind since the federal government issues the money, there are ONLY good consequences of them spending $300 trillion dollars next year on/in the U.S.?

You can't be serious, there is no way you truly believe that the federal government spending ONLY causes good things, regardless of how much they spend.

Read my post again, please.

.that is so long as too many dollars do not chase too few goods creating demand-pull inflation

I was very clear in saying that there is a limit. The limit is when the spending is not in exchange for the production of real goods and services...when it begins crowding out the private sector...when it causes demand-side and cost-push inflation, etc.If we were at full employment and did not have excess capacity and more government injections of dollars into the real economy caused too many dollars to chase too few goods, under those conditions, we would have an increase in the price level that would be bad...so under those conditions there indeed would be negative consequences.

For example, if all taxes were eliminated tomorrow...in that case the deficit level, even after the sequester would probably be higher than the private sector demand for savings and foreign goods, and would probably...almost assuredly...be inflationary and require the FED to raise the fed funds rate and the rate of interest on reserves. So that is probably too much. If we were at full employment already the number gets lower.

We're not even close to full employment. We have people begging for jobs and hours.

Don't mis-characterize my argument by saying that there are no limits when I clearly did not say that in the post you're quoting. "L00k gais...why d0esn't teh FED make u5 @11 mi11i0naiREz! B0at5h0ez sayz its c00!!" That is not what I said. -

gutAnd actually most of CA "surplus" (if that actually proves to be the case, they are slightly less accurate than the CBO) is mainly due to a 10% cut from 2008 spending levels, plus $5B in unexpectedly higher revenues in January. The higher taxes haven't really even kicked in yet, nor have people/business really had an opportunity to run and evade yet.

YES!!!! The sort of "austerity" that Boat claims is PROVEN to be so destructive and horrible. A $10B cut in spending from 2008 levels...10% REAL cut (not just lower increases, REAL cuts)....Move along, nothing to see here. -

QuakerOatshttp://finance.yahoo.com/blogs/daily-ticker/most-overpriced-oversupplied-over-owned-market-history-125751538.html?vp=1

The only question left is -- does obama seize complete dictatorial power when this sheeeet hits the fan? -

BoatShoes

Truly amazing that that guy is probably paid handsomely for such terrible advice and ignorance of monetary operations. These mysterious "foreign creditors" aren't going to come along and force Ben Bernanke and Janet Yellen to vote for higher interest rates to be paid on Treasury securities which are really just savings accounts at the Fed. No rational bond investor would say that the U.S. government cannot pay back a debt denominated in dollars when it creates the dollars. The guy literally has no clue about what he is talking about. The guy's at the Cleveland Fed down the street know this...why doesn't he???QuakerOats;1436898 wrote:http://finance.yahoo.com/blogs/daily-ticker/most-overpriced-oversupplied-over-owned-market-history-125751538.html?vp=1

The only question left is -- does obama seize complete dictatorial power when this sheeeet hits the fan? -

gut

He has more of a clue than you do about investing, apparently. Default risk is only one part of the equation.BoatShoes;1436945 wrote:The guy literally has no clue about what he is talking about.

The govt debt bubble is widely acknowledged, we don't know when it will pop, or if we are on an irreversible course toward that. Aside from debating his timing, pretty much everything he says in that article is true.

And without even going into how 0 rates aren't necessarily healthy, pretty much one of two things must eventually happen - rates will rise (and then interest is going to take up a huge portion of the budget), or the fed will print money as the primary buyer (already heading north of 80% of issuance). That is inflationary, which makes the low yields even less attractive. And one thing we learned in the housing bubble, and to a lesser extent the internet bubble, is inflation in asset prices can be just as damaging and painful. You can continue to focus on the CPI and chirp "all is well", or you can start paying attention.

You continue to demonstrate extreme partisanship, if not complete ignorance, with what is happening in the govt debt market. You seem to believe it is business as usual and that everyone will keep buying whatever debt Uncle Sam issues. This isn't the case. Intergovt debt is now @80% of issuance, up from 30-40% historically. China, and I think Japan, have not been net new buyers of debt in several years. Much of what this "clueless" guy is saying is already happening. -

BoatShoes

And this can continue without being inflationary for decades as it has in Japan. When things start returning normal the FED can raise interest rates on its reserves and/or even has power to tax/delete reserves under the Monetary Control Act. People have been chirping that all is going to end when the Bank of England stops buying our bonds....when the Bank of Japan stops buying our bonds....now when the Bank of China stops buying our bonds...for years and years...you're really just one of the Ron Paul's now and have been wrong since you predicted the end of the world after the Debt Ceiling debacle.gut;1436952 wrote:He has more of a clue than you do about investing, apparently. Default risk is only one part of the equation.

The govt debt bubble is widely acknowledged, we don't know when it will pop, or if we are on an irreversible course toward that. Aside from debating his timing, pretty much everything he says in that article is true.

And without even going into how 0 rates aren't necessarily healthy, pretty much one of two things must eventually happen - rates will rise (and then interest is going to take up a huge portion of the budget), or the fed will print money as the primary buyer (already heading north of 80% of issuance). That is inflationary, which makes the low yields even less attractive. And one thing we learned in the housing bubble, and to a lesser extent the internet bubble, is inflation in asset prices can be just as damaging and painful. You can continue to focus on the CPI and chirp "all is well", or you can start paying attention.

You continue to demonstrate extreme partisanship, if not complete ignorance, with what is happening in the govt debt market. You seem to believe it is business as usual and that everyone will keep buying whatever debt Uncle Sam issues. This isn't the case. Intergovt debt is now @80% of issuance, up from 30-40% historically. China, and I think Japan, have not been net new buyers of debt in several years. Much of what this "clueless" guy is saying is already happening.

Will you eat crow when none of what you say happens or will you be all stubborn about it like when your Romney win prediction failed?

This is not about partisanship. It is about how our sovereign currency works. The United States government debt market is nothing like Greece which you, nor the author, cannot seem to grasp. -

QuakerOatsEven my Wharton School broker agrees "treasuries are a huge bubble".

Meanwhile, in liberal democrat fantasyland, all is well.

Yawn. -

gutBoatShoes;1436966 wrote:And this can continue without being inflationary for decades as it has in Japan. When things start returning normal the FED can raise interest rates on its reserves and/or even has power to tax/delete reserves under the Monetary Control Act. People have been chirping that all is going to end when the Bank of England stops buying our bonds....when the Bank of Japan stops buying our bonds....now when the Bank of China stops buying our bonds...for years and years...you're really just one of the Ron Paul's now and have been wrong since you predicted the end of the world after the Debt Ceiling debacle.

Will you eat crow when none of what you say happens or will you be all stubborn about it like when your Romney win prediction failed?

This is not about partisanship. It is about how our sovereign currency works. The United States government debt market is nothing like Greece which you, nor the author, cannot seem to grasp.

And how has that policy worked for Japan well into their second lost decade? I love how you continue to use examples of failed econ/fisc policies to ignore this is not a solution but a recipe for prolonged economic stagnation, AT BEST.

The point the author was making flew over your head. He's not saying the US economy is like Greece, you're missing the broader implications and understanding because you apparently don't read any objective economic/market analysis. To dismiss that article as clueless only proves your own cluelessness.

The fed is now buying 80%+ of issues. That is not sustainable without severe repercussions. And the Bank of China has already stopped buying our bonds - welcome to 2010. I can't take you seriously when you don't even know the facts.

You cannot grasp that there are other forms of inflation besides CPI. Asset bubbles are every bit as harmful and damaging to an economy, probably more so, when they pop - you SHOULD know that by now. Saying something won't happen because it hasn't happened yet doesn't qualify as thoughtful. -

gut

And muni's. And mortgage backs. And spilling over into other FICC.QuakerOats;1437295 wrote:Even my Wharton School broker agrees "treasuries are a huge bubble".

Meanwhile, in liberal democrat fantasyland, all is well.

It's becoming pretty clear what this prolonged artificial money is doing to the economy, and might explain why it hasn't worked in Japan. First off, the absurdly low rates hurt savers, and it especially hurts retirees on fixed incomes - not exactly a pro-growth for the demand side of the equation.

Second, when rates do rise you're going to DESTROY a MASSIVE amount of wealth not only in treasuries, but in corporates. And you know who owns a ton of that stuff? Pensions. The only way rates don't rise is if the economy continues to suck, like bad gas in a car and probably explains a lot of what is happening in Japan. When rates do rise, that destruction of wealth is going to be far worse than the housing bubble.

If rates don't rise, then we necessarily will have inflation UNLESS the economy continues to suck. I simply don't understand how Boat continues to support a policy that is only sustainable given unacceptable outcomes. Meanwhile, the unfunded state and federal liabilities are only going to grow. -

BoatShoes

I know the facts...you simply think that they are material when they are not. The Fed can continue to be the primary purchaser or our treasury securities while other central banks do not buy them without negative consequences. The Fed could purchase 100% and there is no problem. You act like the FED does not control interest rates when they do. When the economy improves the FED can raise interest rates on reserves as opposed to raising the Fed Funds Rate. As far as asset bubbles go, their negative consequences are easily ameliorated if the FED and other central banks would engage in enough open market operations to prevent the collapse of nominal gdp which was not the case in Japan or in the United States.gut;1437392 wrote:And how has that policy worked for Japan well into their second lost decade? I love how you continue to use examples of failed econ/fisc policies to ignore this is not a solution but a recipe for prolonged economic stagnation, AT BEST.

The point the author was making flew over your head. He's not saying the US economy is like Greece, you're missing the broader implications and understanding because you apparently don't read any objective economic/market analysis. To dismiss that article as clueless only proves your own cluelessness.

The fed is now buying 80%+ of issues. That is not sustainable without severe repercussions. And the Bank of China has already stopped buying our bonds - welcome to 2010. I can't take you seriously when you don't even know the facts.

You cannot grasp that there are other forms of inflation besides CPI. Asset bubbles are every bit as harmful and damaging to an economy, probably more so, when they pop - you SHOULD know that by now. Saying something won't happen because it hasn't happened yet doesn't qualify as thoughtful.

This is not a panacea though. The continual push for contractionary fiscal policy (which you advocate for) only encourages Central Banks to engage in what you consider to be risky monetary policy. -

gut

You starting to know the facts, after I've corrected you several times. First you claimed Japan and China will keep buying treasuries. Wrong. So now you just dig a deeper hole.BoatShoes;1437553 wrote:I know the facts...you simply think that they are material when they are not. The Fed can continue to be the primary purchaser or our treasury securities while other central banks do not buy them without negative consequences. The Fed could purchase 100% and there is no problem. You act like the FED does not control interest rates when they do.

I don't even know where to begin with this. You have absolutely no understanding of how markets work and clear, and you have no concept for the deleveraging process.

That's even below a simpleton's interpretation. "Oh, the fed can print money indefinitely...no problems so far = no problems ever". What you would like to claim is a new normal, or a paradigm shift, or "this time it's different". We hear that occasionally, and it has proven wrong every time the past few decades. The only reason we aren't seeing inflation from this is a shitty economy, and the econ/fisc policy is certainly contributing to the shitty economy. But the fed simply cannot continue printing money with no consequences.

Asset bubbles are easily ameliorated? WTF do you come up with this garbage? Seriously, start reading some objective [read: non-politicized] economic analysis. Contractionary fiscal policy encourages Central Banks to engage in risky behavior? But unbridled, unrestrained expansionary printing presses aren't risky?!? You don't even understand what you are saying, and I think your copy/paste function must be broken because you can't possibly be plagiarizing this crap from anyone even pretending to know what they're saying.