Income Tax and the Rich Myth (Liberals Read)

-

tk421

So, liberals love to bring out the "tax the rich" idea as a solution to the deficit problem. I know I've posted this a few times before on here, but I thought I'd give it its own thread so maybe hopefully (probably not) the concept will sink in.

So, liberals love to bring out the "tax the rich" idea as a solution to the deficit problem. I know I've posted this a few times before on here, but I thought I'd give it its own thread so maybe hopefully (probably not) the concept will sink in.

Using the latest available data from the IRS, from the year 2008.

So, what am I getting at? As you can plainly see, the top 5% of taxpayers in this country pay 58.72% of the taxes. The cutoff for being in the top 5% is only $159,619, not the $250K that President Obama has talked about. For fiscal year 2011, the feds are running a projected deficit of around $1.65 Trillion, so if you increased the income tax on the top 5% to 50%, you could NOT even pay off the current expected deficit. The top 5% had a tax rate of 20.70%, if you made that 50% the government would receive an extra $857,632,500,000 Billion, so the deficit would still be almost $800 Billion.

Also, of note is the tax rates for all these income groups. The highest is of course the top 1% of taxpayers, please note the bottom 50% of taxpayers with a measly 2.59% of the tax paid. The cutoff for the bottom 50% of taxpayers is right around $33,000, so we have 69 million taxpayers who don't pay nearly what they use, or I bet most get more back in earned credits. So, the idea that the top 1-2% of the taxpayers in this country can support our bloated government and we'll all live in a liberal utopia is plain and simple BULLSHIT.

-

tk421

bump

bump -

Belly35

Liberals and Democrats can't do math or read charts .......... WTF where you thinking?

Liberals and Democrats can't do math or read charts .......... WTF where you thinking?

I can tell you this not one Liberal or Democrat will reply to your chart ... or have a comment to rebuke your comments ... they got nothing ... -

tk421

Also, I just noticed this but another liberal myth busted here. Notice the top 5% have only 34.73% of the total AGI but pay over 58% of the taxes. So a group who only makes slightly over 1/3 of the money pays more than half of all taxes. Sounds like to me the rich pay more than their fair share of the taxes.

Also, I just noticed this but another liberal myth busted here. Notice the top 5% have only 34.73% of the total AGI but pay over 58% of the taxes. So a group who only makes slightly over 1/3 of the money pays more than half of all taxes. Sounds like to me the rich pay more than their fair share of the taxes. -

Writerbuckeye

The Democrats have lied so much with their class warfare rhetoric that they've come to believe it, even though it can easily be shown to be false. Put the numbers in front of them and they simply stick their fingers in their ears, close their eyes, and go, "LALALALALALALALALALALALALA."

The Democrats have lied so much with their class warfare rhetoric that they've come to believe it, even though it can easily be shown to be false. Put the numbers in front of them and they simply stick their fingers in their ears, close their eyes, and go, "LALALALALALALALALALALALALA." -

Belly35

Still no comments by the Liberals or Democrats sector of the OC ... those socialist cowards

Still no comments by the Liberals or Democrats sector of the OC ... those socialist cowards -

Ty Webb

After the way you act at times Belly...you have no right calling anyone a coward

After the way you act at times Belly...you have no right calling anyone a coward -

BoatShoestk421;815632 wrote:Also, I just noticed this but another liberal myth busted here. Notice the top 5% have only 34.73% of the total AGI but pay over 58% of the taxes. So a group who only makes slightly over 1/3 of the money pays more than half of all taxes. Sounds like to me the rich pay more than their fair share of the taxes.

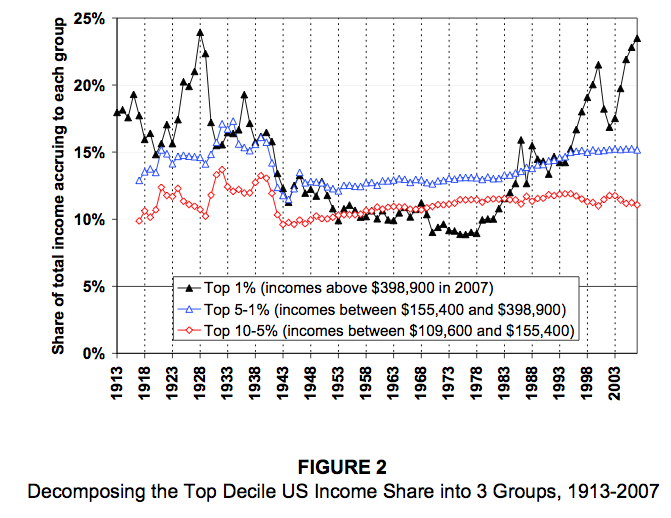

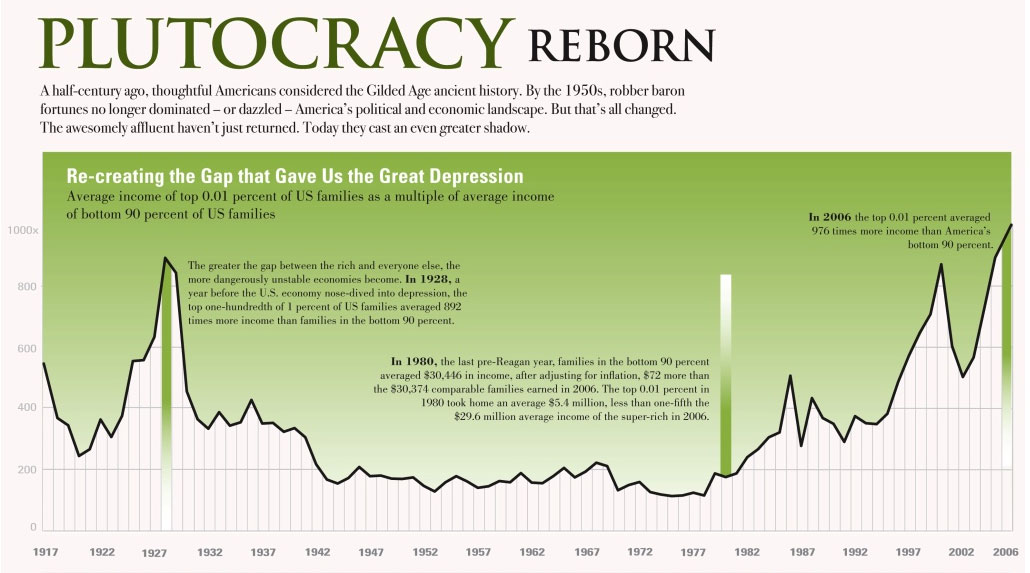

The sad thing is I gather from your posts that you consider yourself an Austrian and yet you are totally unaware of their major contribution to mainstream economic theory with the marginal revolution. There's no point into posting all of it again as I've posted it over again. You also seem unaware of the reality of compounding of economic growth over the years as the only ones seeing significant growth since 1975 when a CEO's pay was 3 times the average worker and is now 400 times the average worker. That bottom 50% in your table would gladly pay more taxes if it meant that their pay was in its former ratios.

But as to the law of diminishing marginal utility which, even if higher income earners are paying a larger percentage of their income, still stipulates that they are giving up far less utility to the government.

wealth and income inequality reduces the sum total of personal utility because of the decreasing marginal utility of wealth. For example, a house may provide less utility to a single millionaire as a summer home than it would to a homeless family of five. The marginal utility of wealth is lowest among the richest. In other words, an additional dollar spent by a poor person will go to things providing a great deal of utility to that person, such as basic necessities like food, water, and healthcare; meanwhile, an additional dollar spent by a much richer person will most likely go to things providing relatively less utility to that person, such as luxury items. From this standpoint, for any given amount of wealth in society, a society with more equality will have higher aggregate utility. Some studies (Layard 2003;Blanchard and Oswald 2000, 2003) have found evidence for this theory, noting that in societies where inequality is lower, population-wide satisfaction and happiness tend to be higher.

It is also erroneous to solely focus on income because, as noted before, the compounding growth in conjunction with decreasing tax rates for higher income earners has allowed those very rich to expand their net worth tremendously so has to have 80% of the wealth of this country (assets - liabilities).

You also fail to point out the even more telling factoid of your chart...the massive inequality between the top 1% and .1% between even the top 5% because the top 5% are often ordinary income earners whereas those in the higher percentages have a lower effective rate in the form of capital gain and qualified dividends.

Overall, no one disputes that the wealthier pay more taxes but when the top 10% earns 45% of the nation's income and the bottom 50% earns 12.7% and those ratios get farther and farther apart compounding over 20 years, combined with the catechism that you could never raise taxes on that bottom 50% of course they're not going to pay taxes. Once the bush tax cuts are about to expire again a Conservative will be on here talking about the largest tax increase in history...and then a month later talk about how no one pays taxes.

I mean MajorSpark did taxes for a guy who earns $50k a year and he got a tax refund....you saying those kinds of hard working families who haven't had their wages rise in 20 years wouldn't love to pay some taxes if he got a $30,000 raise...and his wife probably works too!

I mean, are you really proposing that we raise the taxes on the bottom 50% of americans? Go ahead and propose it...Especially when they get so much more utility out of their dollars....that 10% of their AGI that they keep is going purely towards consumption for most of them as evidence by the lack of saving over the last 20 years.

You want the bottom 50% to pay more taxes but you will not support any policies that would increase their hiring...you do not demand that their bosses who use essentially slave labor instead and earn 400 times what they do pay them higher wages. You decry labor unions despite Taft-Hartley bringing along the snow ball of the steady demise of the American middle class.

Again, I'm sure you're going to talk to me about the worthless bums who stroll into my gf's bank to get their SSI check...as if that is the source of our problems.

I mean it makes no sense to focus solely on income.

Dr. John Rutledge, an economist, was one of the principal architects of the Ronald Reagan economic plan in 1980-81 and was an advisor to the George W. Bush White House on tax policy. He now runs his own private equity investment firm. He did an analysis of the Fed's z1 form which tracks the balance sheet of the U.S. economy. In the awful year that was 2008 our people had 188 trillion dollars worth of national assets. That dwarfs our national debt and is a better ratio than countless successful businesses...but yet we're hearing cries of our impending bankruptcy...because our debt is approaching our yearly national income. Add in that $141 trillion of those assets are financial assets.

Most of our people as individuals have negative net worth let alone debt greater than their annual income!

Now think about that...The top 10% have control over 93% of $141 trillion worth of financial assets. They have so much money that it has incredibly low utility in comparison to the average american. They don't even feel the pain of their taxes in the same way most taxpayers do if they lose a $10 bill. This is basic economics and the thing that put the Austrian School on the map.

http://3.bp.blogspot.com/_RSMVZRZECdI/TNGDgmEht5I/AAAAAAAACGI/E1veBkaNkqM/s400/wealth.distribution.2007.graph1.gif

The bottom line is this: The United States is the most powerful nation the world has ever known and it was founded upon a merit conception of justice...that people are rewarded for what they earn and produce as free individuals with rights bestowed from God. America's workers are our producers...that bottom 80% with no wealth to speak of...are among the most talented and skilled and educated and productive that you will find, despite the lack of investment in their education each and every year and nearly all of them besides the glaring examples we're all too well aware of...aren't looking for a handout and never have. Yet, since 1975...despite working just as hard and growing our economy throughout that time....they have not been rewarded for their efforts...And despite, if we were to look at our national balance sheet which is not dire at all (as opposed to our yearly debt to income ratio)...the national debate has centered around destroying medicare and raising their taxes because high income earners (which includes a miniscule percent of the tea party) are "taxed enough already" when that clearly is not the case if you consider, aggregated wealth, compounding of wealth over years and the law of diminishing marginal utility.

Most of America is on hard times but a very few don't have a care in the world and they are the one's with all of the power and both the democrats and republicans are in their back pocket. But I dunno...it's like Peter Finch said in the film network...we come home and we turn on our tube's...these days the internet, and we have the whole world at our fingertips and maybe we just don't care.

Apologies for the long reply as you won't be convinced anyway. I'll take some inadequate health care vouchers and lose my tax expenditures so George Soros can have a 0% Tax Rate on his income and we can have a balanced budget 30 years from now! Maybe he will spend it on a SuperPAC! -

I Wear PantsNo no no Boatshoes, all the liberals are just lazy and want handouts. The rich are just the hardest working people and we must not tax them. In fact, we must not tax anyone ever because taxes are eeeeeeeeevvvvillll. The more we cut taxes the better everything will be.

-

Manhattan Buckeye

Hyperbole much? The weird thing is that this ridiculous post is more in line with the opposing view, that all we've worked for really belongs to the government. We get taxed alot already.....that isn't the problem, unless you are unemployed, have no hope of employment and have a vested interest in wealth redistribution, how can you not be angry? Even so, how is that working out for you? The U.S.'s misery is nearly at 30's era level.I Wear Pants;816053 wrote:No no no Boatshoes, all the liberals are just lazy and want handouts. The rich are just the hardest working people and we must not tax them. In fact, we must not tax anyone ever because taxes are eeeeeeeeevvvvillll. The more we cut taxes the better everything will be.

Standing up for Boatshoes - likely not a good idea. -

I Wear PantsOh no, I agree that the opposite is equally ridiculous.

I find anyone out towards either the left or the right to be distasteful at least politically.

Yeah, and in the 30s wealth distribution was completely messed up. I'm not saying we take money from the wealthy and give it to the poor. But cutting taxes has not worked. What good has the Bush tax cuts done? -

Manhattan BuckeyeBe that is it may, the "Left" has run this country for the last two years and it has been an unmitigated disaster, yet tools like Krugman and Yglesias are claiming we haven't gone "left" enough. Does the situation in Greece not mean anything? Produce nothing, promise everything = profit?

-

tk421

I Wear Pants;816062 wrote:Oh no, I agree that the opposite is equally ridiculous.

I Wear Pants;816062 wrote:Oh no, I agree that the opposite is equally ridiculous.

I find anyone out towards either the left or the right to be distasteful at least politically.

Yeah, and in the 30s wealth distribution was completely messed up. I'm not saying we take money from the wealthy and give it to the poor. But cutting taxes has not worked. What good has the Bush tax cuts done?

I don't know where anyone said cut taxes more. I know I never said that, all I've shown is the idea that the rich will fix our problems is obviously flawed. As I've pointed out, you can tax the rich at 50% and not get enough to cover the deficit. How is allowing the tax rate for the rich to go up 4% points going to do anything but piss 'em off? It won't come close to covering 1/4th of the debt, the Bush tax cuts are a red herring for the left they are seriously missing the boat. -

I Wear Pants

And the eight before that were equally as disastrous so I take offense at anyone who thinks that one side has a monopoly on bad or good ideas.Manhattan Buckeye;816064 wrote:Be that is it may, the "Left" has run this country for the last two years and it has been an unmitigated disaster, yet tools like Krugman and Yglesias are claiming we haven't gone "left" enough. Does the situation in Greece not mean anything? Produce nothing, promise everything = profit?

And tk, I've never said or thought that taxes the rich more would be an end-all be all cure for our problems. But I don't think one exists. I think the way we fix this thing is a bunch of smaller steps, ending the Bush tax cuts, ending the war on drugs, adding some regulations where they are needed in the banking industry, firmly supporting net neutrality in law because the internet is an important economic engine, etc, etc. There's lots of small things that we could do now that would have a pretty good impact. -

Manhattan Buckeye"And the eight before that were equally as disastrous so I take offense at anyone who thinks that one side has a monopoly on bad or good ideas."

Not even close.....the media was willing to impeach W when the UE rate hit 6%, we've been more than 50% above that and all we hear is excuses, excuses, excuses. I've worked since 1998, I'd sell my right testicle to go back to the W era, if a GOP President was in the WH right now we'd have a daily feed of the economic misery and even more importantly the no "hope" for the future, we've been had. -

I Wear PantsSo the UE rates seen from 08 to now popped up out of disastrous policies from Obama and had nothing to do with the failed policies of Bush and before him Clinton? Both of whom did nothing about the financial industry becoming ridiculously over leveraged?

-

Manhattan BuckeyeIt has to do with American confidence, and right now it is in the toilet. Try starting your business in today's market with all of the regulations and "reforms" this administration has enacted. He's simply a poor leader, and a poor President that doesn't have a freaking clue how to even incorporate one's own business. He's an empty suit and his empty suit policies are disastrous.

Why do I even need to argue this? Look around? Does this look like a country in good shape, or at least one with "hope" that good times will come again? I see a third world country. -

tk421

I don't really care if they increase the top tax rate back to 39.6% or whatever it was. However, and we only have 2008 data to go on but I imagine it's even worse for 2011 with the recession, that 4% increase will only net the federal government a little less than $70B, out of a deficit of around $1.65 Trillion. It's a drop in the bucket, hell they were fighting over spending cuts for months that were almost as much as that.

I don't really care if they increase the top tax rate back to 39.6% or whatever it was. However, and we only have 2008 data to go on but I imagine it's even worse for 2011 with the recession, that 4% increase will only net the federal government a little less than $70B, out of a deficit of around $1.65 Trillion. It's a drop in the bucket, hell they were fighting over spending cuts for months that were almost as much as that. -

I Wear Pants

I never said we were in perfect shape. I just disagree with you about some of the causes and solutions to our problems.Manhattan Buckeye;816069 wrote:It has to do with American confidence, and right now it is in the toilet. Try starting your business in today's market with all of the regulations and "reforms" this administration has enacted. He's simply a poor leader, and a poor President that doesn't have a freaking clue how to even incorporate one's own business. He's an empty suit and his empty suit policies are disastrous.

Why do I even need to argue this? Look around? Does this look like a country in good shape, or at least one with "hope" that good times will come again? I see a third world country. -

coyotes22

Lower taxes= more jobs

Lower taxes= more jobs

More Government= less jobs -

Belly35

I Wear Pants;816071 wrote:I never said we were in perfect shape. I just disagree with you about some of the causes and solutions to our problems.

I Wear Pants;816071 wrote:I never said we were in perfect shape. I just disagree with you about some of the causes and solutions to our problems.

-

derek bomar

tk421;814814 wrote:SThe top 5% had a tax rate of 20.70%, if you made that 50% the government would receive an extra $857,632,500,000 Billion, so the deficit would still be almost $800 Billion.

tk421;814814 wrote:SThe top 5% had a tax rate of 20.70%, if you made that 50% the government would receive an extra $857,632,500,000 Billion, so the deficit would still be almost $800 Billion.

I'd love for a 20% tax rate. -

BGFalcons82

tk421;816070 wrote:I don't really care if they increase the top tax rate back to 39.6% or whatever it was. However, and we only have 2008 data to go on but I imagine it's even worse for 2011 with the recession, that 4% increase will only net the federal government a little less than $70B, out of a deficit of around $1.65 Trillion. It's a drop in the bucket, hell they were fighting over spending cuts for months that were almost as much as that.

tk421;816070 wrote:I don't really care if they increase the top tax rate back to 39.6% or whatever it was. However, and we only have 2008 data to go on but I imagine it's even worse for 2011 with the recession, that 4% increase will only net the federal government a little less than $70B, out of a deficit of around $1.65 Trillion. It's a drop in the bucket, hell they were fighting over spending cuts for months that were almost as much as that.

The Leftists are also arguing that the rich will just say, "aw shucks...ya got me", and pony up the additional 4%. These evil scum rotten scoundrels didn't get rich by just sitting around and having it fall in their lap, much to the chagrin of Progressives. They earned it and they're not going to just fork over more because Barry and Harry want them to do it. There's a reason why corporations like GE don't pay much in federal taxes...they have hundreds of people dedicated to NOT PAYING TAXES LEGALLY. What did Warren Buffet say a couple years ago...he only pays the Capital Gains rate of 15%. Does anyone think he's the ONLY rich evil rotten scum that does this? How does raising the income tax rate 4% affect him? Answer...it DOESN'T!!

The Left never has understood that tax changes are dynamic, not static. If more of something is taxed, you get less of it. Econ 101. Yet, here is Boatshoes on another thread saying just the opposite and economic nirvana is just around the corner if the Clinton-era rates come back into fruition. -

coyotes22

BGFalcons82;816224 wrote:The Leftists are also arguing that the rich will just say, "aw shucks...ya got me", and pony up the additional 4%. These evil scum rotten scoundrels didn't get rich by just sitting around and having it fall in their lap, much to the chagrin of Progressives. They earned it and they're not going to just fork over more because Barry and Harry want them to do it. There's a reason why corporations like GE don't pay much in federal taxes...they have hundreds of people dedicated to NOT PAYING TAXES LEGALLY. What did Warren Buffet say a couple years ago...he only pays the Capital Gains rate of 15%. Does anyone think he's the ONLY rich evil rotten scum that does this? How does raising the income tax rate 4% affect him? Answer...it DOESN'T!!

BGFalcons82;816224 wrote:The Leftists are also arguing that the rich will just say, "aw shucks...ya got me", and pony up the additional 4%. These evil scum rotten scoundrels didn't get rich by just sitting around and having it fall in their lap, much to the chagrin of Progressives. They earned it and they're not going to just fork over more because Barry and Harry want them to do it. There's a reason why corporations like GE don't pay much in federal taxes...they have hundreds of people dedicated to NOT PAYING TAXES LEGALLY. What did Warren Buffet say a couple years ago...he only pays the Capital Gains rate of 15%. Does anyone think he's the ONLY rich evil rotten scum that does this? How does raising the income tax rate 4% affect him? Answer...it DOESN'T!!

The Left never has understood that tax changes are dynamic, not static. If more of something is taxed, you get less of it. Econ 101. Yet, here is Boatshoes on another thread saying just the opposite and economic nirvana is just around the corner if the Clinton-era rates come back into fruition.

Also, those big mean evil rich people control millions of jobs. More taxes= less jobs!! -

derek bomar

capital gains and income tax should be the same rate, and for everyone...what that rate is, who knows

capital gains and income tax should be the same rate, and for everyone...what that rate is, who knows